Digital Solutions for the Financial Industry | Parmagito Digital

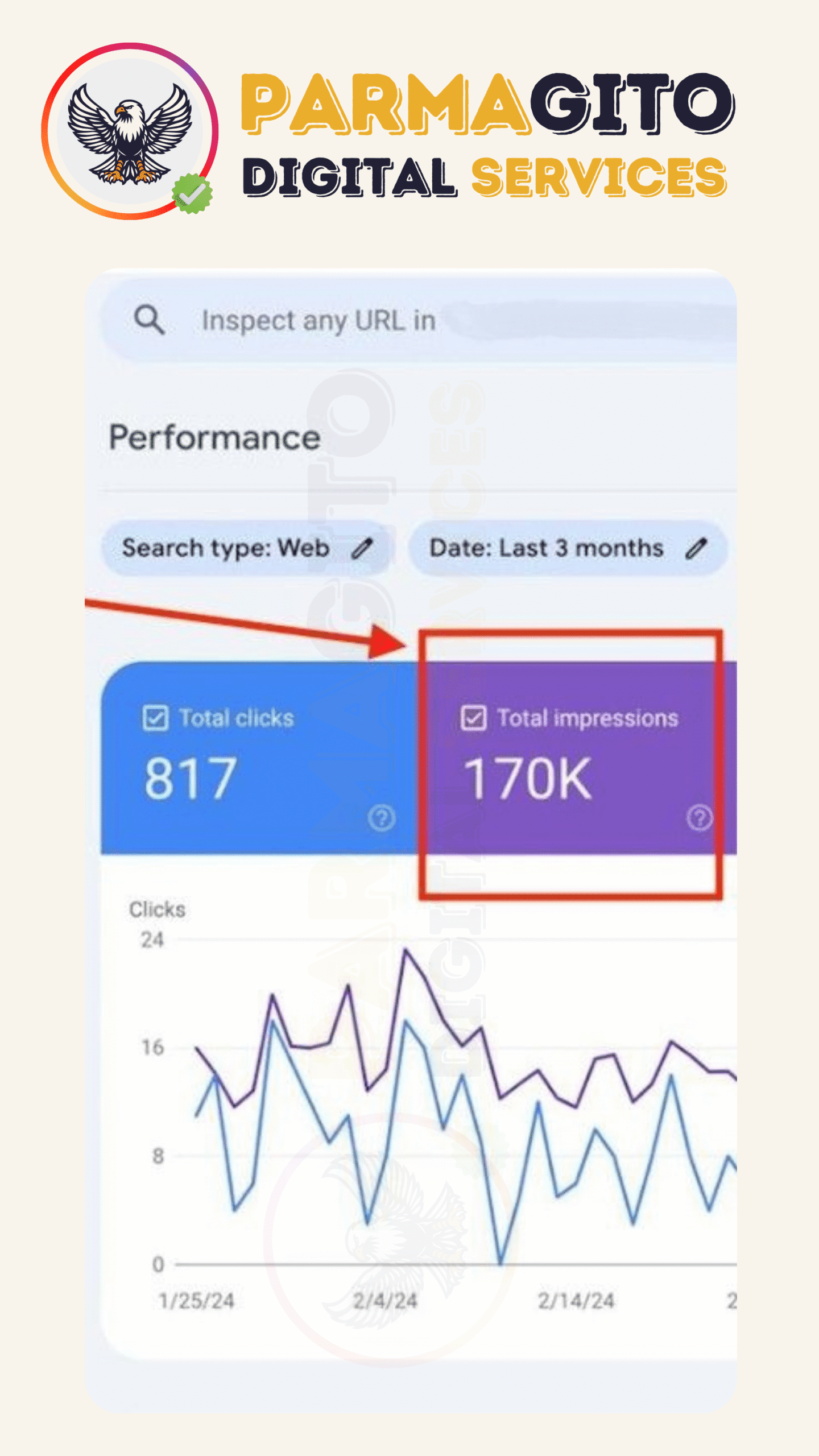

In today’s fast-paced financial world, success depends on trust, security, and innovation. At Parmagito, we deliver tailored digital solutions designed to meet the unique challenges of banks, investment firms, insurance companies, and financial service providers. From secure websites and mobile apps to advanced fintech integrations, we help financial institutions stay competitive, compliant, and connected with their clients.

Challenges in the Financial Industry and How Parmagito

The financial industry is one of the most dynamic and highly regulated sectors in the world. Banks, investment firms, and insurance providers face constant challenges such as cybersecurity threats, strict compliance requirements, digital transformation, and increasing customer expectations. Traditional systems are no longer enough to ensure growth and competitiveness.

At Parmagito, we understand these challenges. That’s why we design and implement secure, scalable, and innovative digital solutions that empower financial institutions to adapt quickly, protect sensitive data, and deliver seamless customer experiences. With our expertise, financial organizations can focus on growth while we take care of the technology behind it.

Why Financial Institutions Trust Parmagito

Financial institutions need more than just technology—they need a partner who understands the complexity of the industry and delivers reliable, future-ready solutions. Parmagito has years of experience helping banks, insurance companies, and investment firms navigate digital transformation while ensuring security, compliance, and performance.

- Proven Expertise: Deep knowledge of financial systems, compliance, and fintech innovations.

- Security First: Advanced cybersecurity practices to protect sensitive financial data.

- Custom Solutions: Tailored websites, apps, and integrations designed specifically for financial services.

- Regulatory Compliance: Solutions aligned with local and international financial regulations.

- Scalability & Performance: Robust platforms that grow with your institution.

- Client-Centered Approach: Focus on enhancing customer experience and trust.

GET A QUOTE

Specialized Digital Services for the Financial Sector

We provide end-to-end digital services tailored to the specific needs of financial institutions. Each solution is designed to ensure security, compliance, and growth in today’s competitive market.

Build high-performance websites with strong encryption and data protection.

Develop secure and user-friendly apps for banking and financial services.

Seamlessly connect with payment gateways, wallets, and financial APIs.

Custom portals for policy management, claims tracking, and client services.

Platforms for portfolio management, investor dashboards, and real-time updates.

Manage client relationships, leads, and compliance records effectively.

Advanced protection against cyber threats and fraud attempts.

Ensure compliance with financial regulations and reporting standards.

Leverage data for risk analysis, fraud detection, and predictive insights.

Continuous monitoring, updates, and 24/7 technical support.

Our 5-Step Approach to Empower Financial Institutions

At Parmagito, we simplify the digital transformation journey for financial organizations by following a structured 5-step framework. This proven approach ensures security, efficiency, and measurable growth at every stage.

Discovery & Analysis

Understanding your institution’s goals, challenges, and compliance requirements.

Strategy & Planning

Designing a tailored digital roadmap aligned with financial regulations and industry trends.

Financial

Design & Development

Building secure websites, mobile apps, and fintech integrations.

04

Testing & Compliance Check

Ensuring data protection, security, and regulatory compliance before launch.

05

Launch & Ongoing Support

Deploying solutions with continuous monitoring, updates, and dedicated support.

What Our Financial Clients Say

Mohammed Al-Ajmi

CEO, Investment Firm

Dr. Hala Abdelrahman

Operations Director

Fahad Al-Qahtani

Startup Founder

Reem Al-Kilani

Entrepreneur

Sami Al-Dosari

Product Development Manager

Najla Al-Saffar

Communications Manager

Financial Institutions That Trust Parmagito

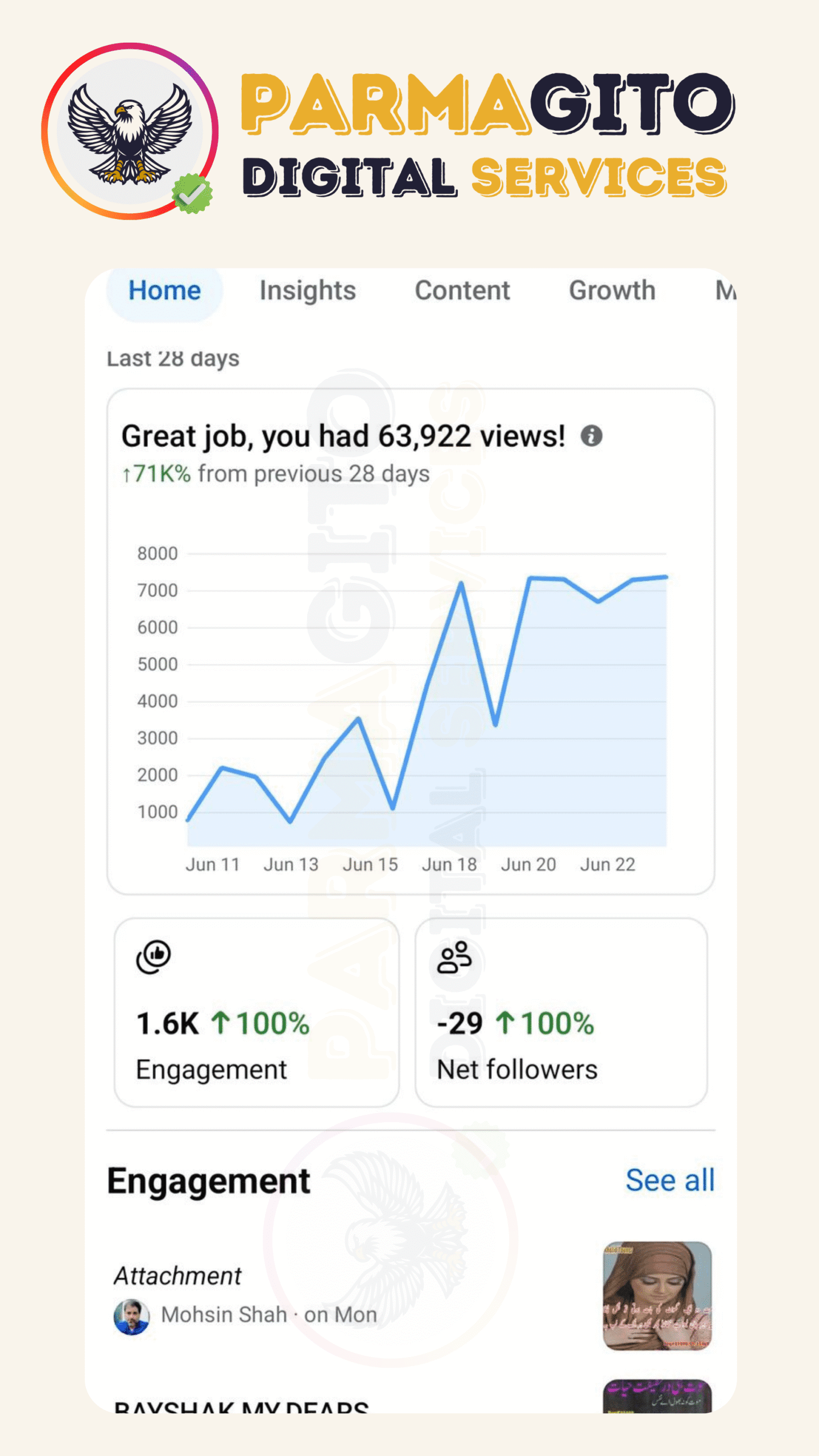

Over the years, Parmagito has partnered with leading financial organizations across the Middle East and beyond. Our clients range from established banks to innovative fintech startups, all benefiting from our secure and future-ready digital solutions.

Frequently Asked Questions about Financial Digital Solutions

Find answers to the most common questions about Parmagito’s branding and design services. These FAQs are designed to help you understand our process, timelines, and how strong branding can impact your business and SEO results.

Q1: How can Parmagito improve online banking services?

We create secure, user-friendly banking websites and apps with features like account management, online transfers, and customer support.

Q2: Can digital platforms simplify claims processing?

Yes. Our insurance portals include online claims tracking, document management, and customer dashboards to reduce processing time.

Q3: Do you build platforms for portfolio management?

Absolutely. We design custom portals with real-time updates, investor dashboards, and analytics to boost engagement.

Q4: Can you integrate mobile wallets and payment gateways?

Yes. We specialize in FinTech integrations that support mobile payments, e-wallets, and secure API connections.

Q5: Are your solutions compliant with international financial regulations?

Yes. All our platforms follow strict compliance standards including PCI DSS, GDPR, and local financial laws.